Are you sick of Forbes appearing in search results?

For topics that Forbes doesn’t have any expertise in?

Here’s the organic rankings for “best pet insurance”:

Forbes ranks #2. Not sure a business website knows how pet insurance actually works. But okay.

They also have the #1 ranking for best cbd gummies:

Because it’s a marijuana category, PPC ads don’t show for that search term at all. I bet the traffic and click through rate is unreal. Forbes also has another post ranking at #4 for the same keyword. They might be making over $100K/month just off these two blog posts. I’ve made that much off a single post that ranked #1 for a major product term. Since the normal ads don’t show, this might be one of the most lucrative affiliate terms on all of Google. It’s definitely up there.

Let’s do one more. Here’s Forbes ranking #2 for “how to get rid of roaches:”

And right at the top of their cockroach post, a juicy ad:

A highly ranked “how to” post can make just as much money as a “best of” post if you cram an ad into it. Done that plenty of times myself.

So. Does anybody think Forbes is the best authority on pet insurance, CBD gummies, and cockroach infestations?

I sure as fuck don’t.

The Rise of Forbes in Google – Parasite SEO Perfected

None of these Google rankings are an accident. And I’m not cherry picking a few high ranking posts.

Forbes completely dominates Google today.

In 2020, a completely different company from Forbes partnered with Forbes to run their SEO affiliate business. They created a new company, made it look like it’s part of Forbes (it’s not), and then went to town exploiting every last corner of Google.

They refer to themselves as Forbes Advisor publicly but the official entity is Forbes Marketplace.

In fact, this Forbes affiliate frankenstein has gotten so big and so successful that I found claims that Forbes Marketplace is trying to buy the actual Forbes company. More on this later.

Forbes Marketplace runs a few sections of the Forbes website.

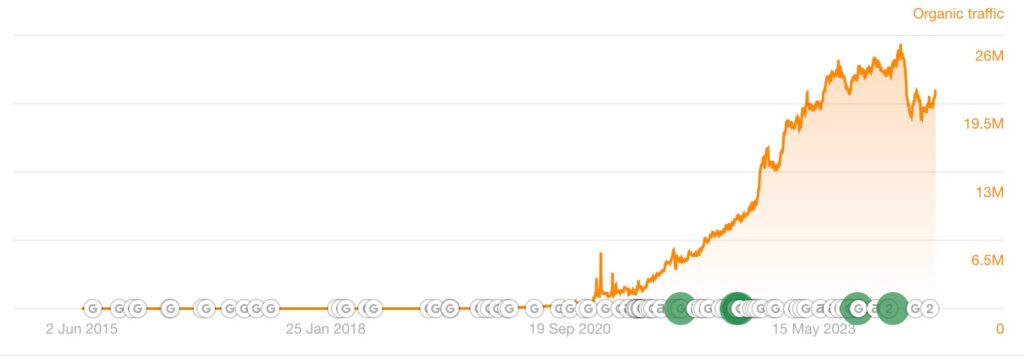

Here’s the traffic for forbes.com/advisor/:

From nothing to over 20 millions search visits per MONTH in less than 4 years. Holy shit is that some serious SEO growth. This was the first section of the Forbes website that they began operating.

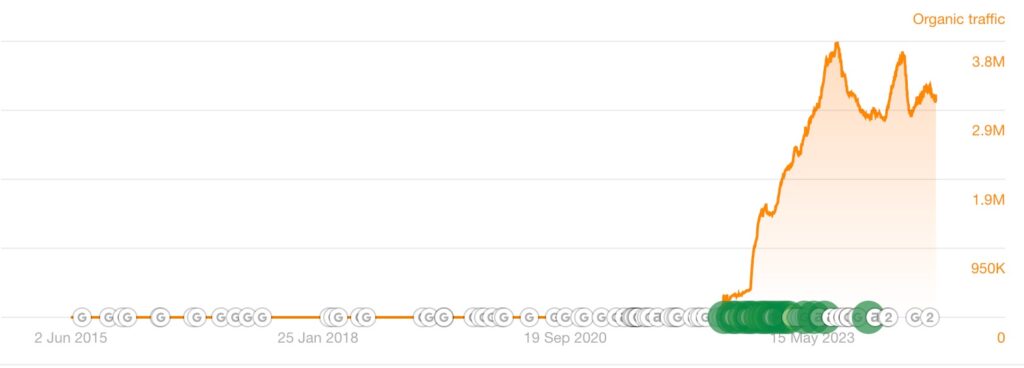

This isn’t the only section of Forbes.com that this company runs. They also manage forbes.com/home-improvement/:

And they manage forbes.com/health/:

To recap the current search traffic controlled by Forbes Marketplace:

- Forbes Advisor = 20.6 million search visits/month

- Forbes Home Improvement = 2.9 million search visits/month

- Forbes Health = 3.8 million search visits/month

- Total = 27.3 million search visits/month

For context, Nerdwallet gets 14 million search visits/month across its entire site. Forbes Marketplace is almost twice the size of Nerdwallet already. Nerdwallet was founded in 2009, it took them 15 years to get as big as they are. Forbes Marketplace basically 2X’d their size in a third of the time.

I’m using Ahrefs data which is never perfectly accurate but the overall scale will be close.

The crazy part: Forbes Marketplace isn’t going to stop there. They’ve ALSO been working on Forbes Betting for the last two years, it’s already at 455K search visits per month:

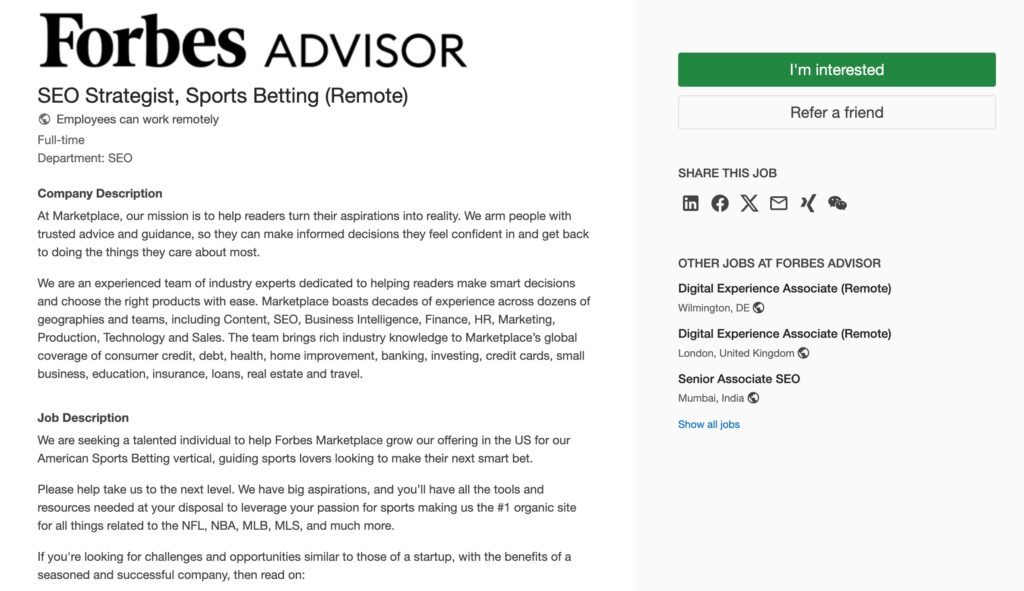

And there’s an open role in their careers section for an SEO Strategist, Sports Betting right now:

They want to create “the #1 organic site for all things related to the NFL, NBA, MLB, MLS, and much more.”

You know who I think of when I think of professional sports? Not fucking Forbes.

Forbes Marketplace is the single largest (and most successful) parasite SEO program of all time. And it’s just getting started.

I firmly believe that Forbes Marketplace is going to go after EVERY affiliate category unless Google stops them. I wouldn’t be surprised if Forbes starts pushing Viagra content soon.

Who is Forbes Marketplace? Untangling Who Manages the Forbes Affiliate Program

You’d think that the Forbes company is publishing this content and taking all the cash. They’re not.

Actually, the players involved have taken steps to obscure who’s actually running the show. It’s a completely different company, Forbes Marketplace. And while Forbes Marketplace is positioned as a subsidiary of Forbes, Forbes only owns a minority stake.

Now, I’m really going to get into the weeds for the rest of this post. We’re going to dig through SEC filings, business registrations, and some notes from a scorned founder. This might seem tedious. But when a single company dominates Google to the extent that millions of Americans are pushed to buy their recommended products every month, I think it’s important to know who’s calling the shots.

At the end, I’ll tell you who the key players are for the Forbes affiliate program. It’s also a world-class case study on how to set up an affiliate parasite program to rake in hundreds of hundreds of millions of dollars in revenue. In fact, the affiliate program is SO successful that the folks running Forbes Marketplace are trying to buy Forbes in its entirety. It’s nuts.

Let’s head down the rabbit hole.

If you dig around the affiliate content on Forbes, you’ll end up on Forbes Advisor:

Forbes Advisor is used in two ways which can make this confusing.

- Forbes Advisor is the B2B, finance, and insurance affiliate category on the Forbes website. This is where the team started.

- As they expanded, Forbes Advisor got co-opted as the brand they operate under for all the affiliate content on Forbes. Now Forbes Advisor is also the public team that all the other affiliate categories operate under (like Health and Home Improvement). When Forbes publicly refers to its affiliate content, it uses Forbes Advisor to describe all of it.

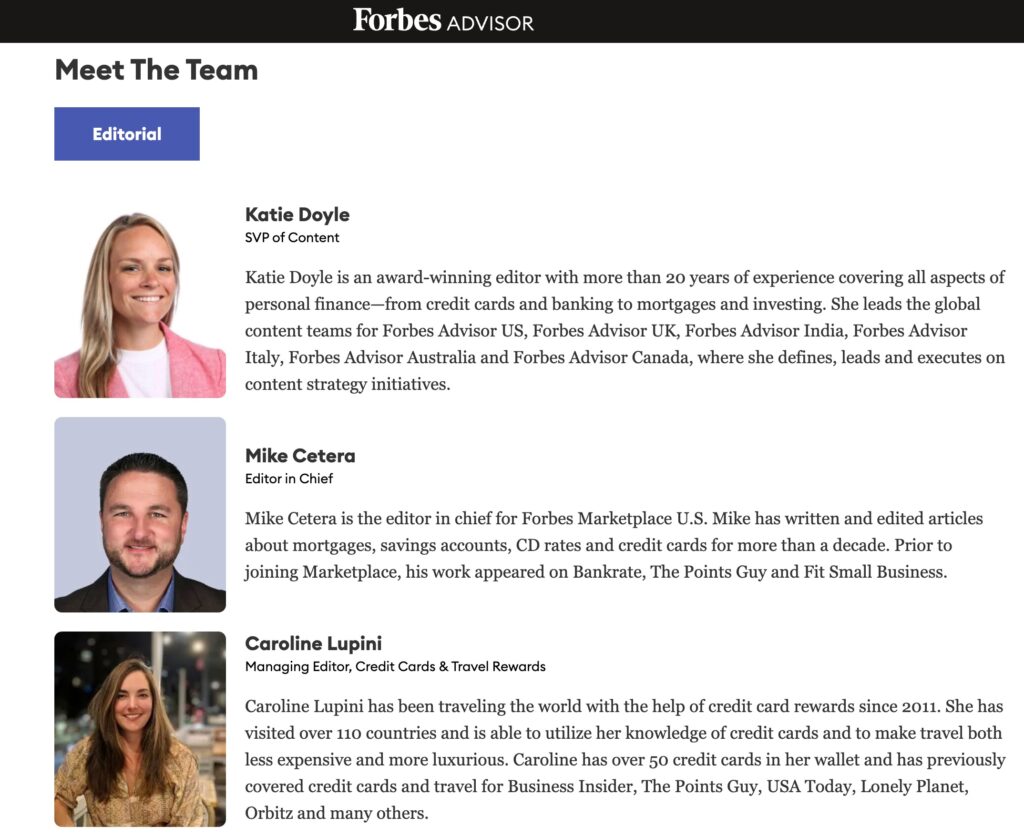

Digging deeper, this is how the Forbes Advisor team presents itself:

If you check the other affiliate categories on Forbes, Katie Doyle is always listed at the top as the SVP of Content. Then the content team dedicated to that category.

But as anyone in the affiliate game knows, content is only one piece of the business. You’ll need tons of folks in revenue management, link building, tech, and company operations. Where are those people?

And where’s the CEO along with the rest of the leadership team?

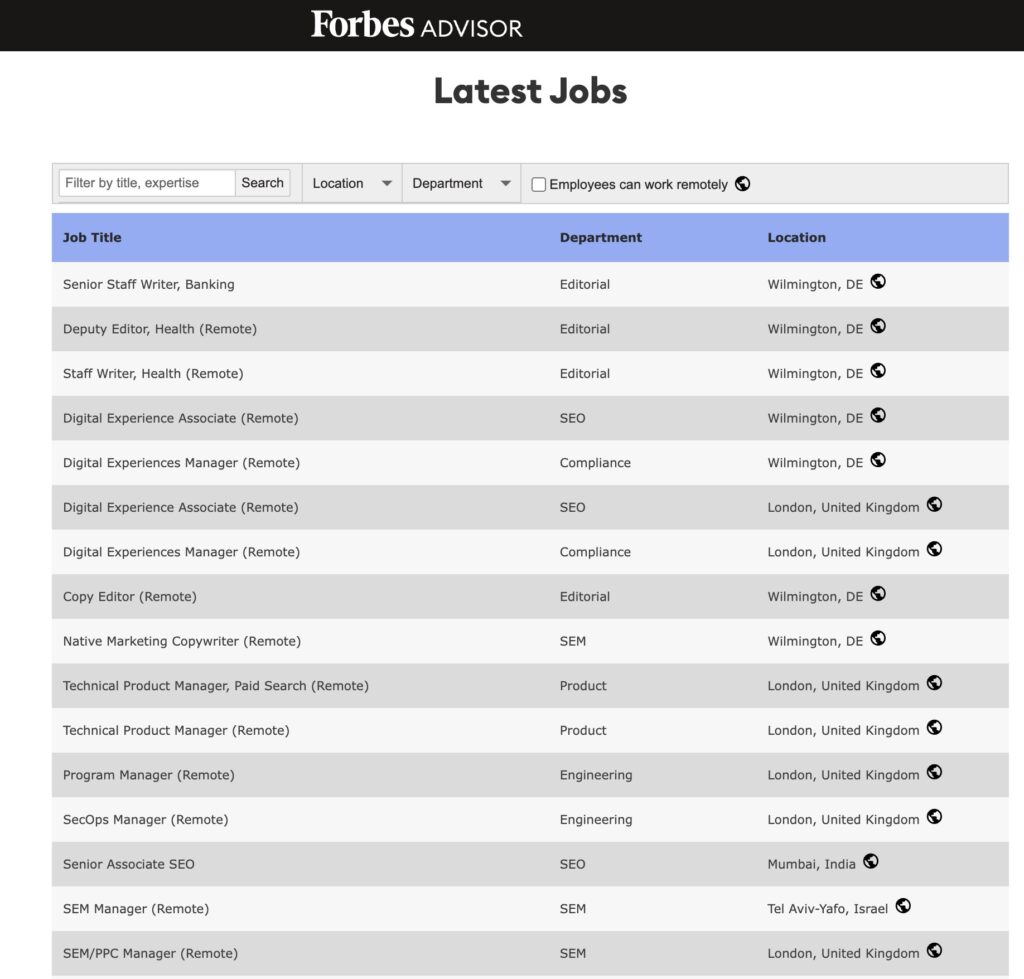

There are tons of open roles across Delaware, India, Israel, and London:

Again, someone might assume that all this other stuff is managed by Forbes itself. Again, it’s not. All of this is a completely separate company.

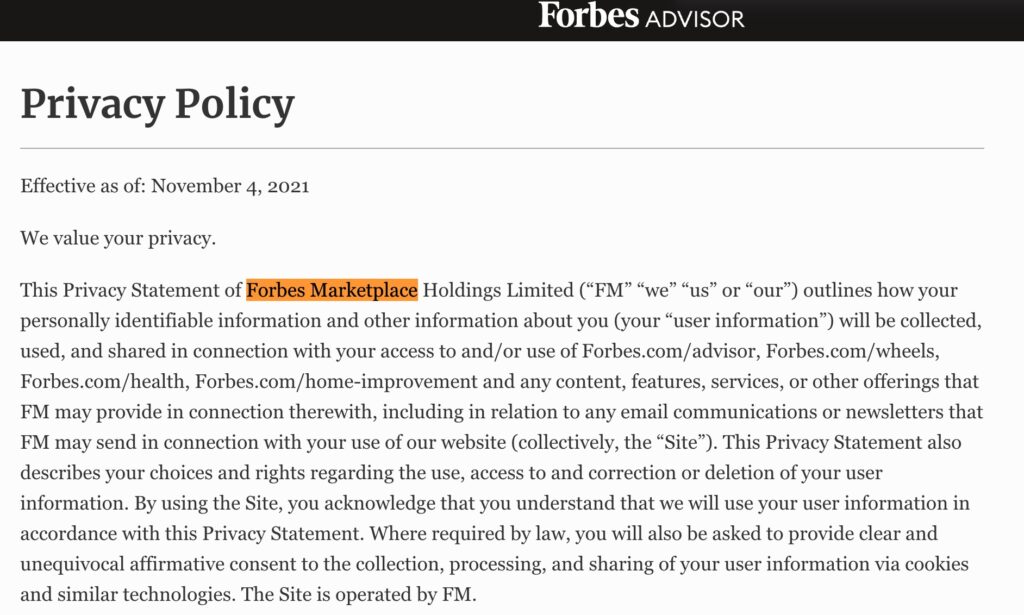

The first time I realized that Forbes Advisor is basically a public front is when I checked the Forbes Advisor privacy policy. It references an organization called Forbes Marketplace Holdings Limited:

Looking for information on Forbes Marketplace will bring up this SEC filing which has a few mentions of Forbes Marketplace. Here’s how it’s described:

Yup, an affiliate content business going after every content category that it can.

There’s a few other really interesting facts in that SEC filing.

Forbes Marketplace did $22 million in annual revenue from Jan 2021 to Sep 2021:

Making a projection for Q4, we can confidently say that Forbes Marketplace did at LEAST $29 million in revenue for all of 2021. Traffic was in a big upswing during this period so I’m confident that revenue grew even faster than the pace set for the first 9 months of 2021.

Forbes Marketplace EBITDA was $6.7 million from Jan 2021 to Sep 2021:

They were already rolling in cash in 2021 and they had barely gotten started.

Forbes Marketplace was officially launched in Sept 2019:

Now for the good stuff. Forbes purchased $1,757,000 worth of equity in Forbes Marketplace Holdings Limited:

Oooooh man. That “See Note 4” sure does look tasty. What does it say?

Here it is in full:

All the good shit is always buried in the notes. This tells us EXACTLY what’s going on. I’ll recap:

- Forbes officially granted Forbes Marketplace the right to use its trademark.

- Forbes has one seat on the Board of Directors of Forbes Marketplace.

- The majority shareholder of Forbes ALSO invested in Forbes Marketplace and also got a board seat.

- Overall, Forbes controls two board seats of Forbes Marketplace.

- Forbes initially owned 20% of Forbes Marketplace but purchased additional shares from the majority Forbes shareholder, bringing the total ownership to 39.53% after some share dilution.

In this filing, Forbes claims they control Forbes Marketplace through its two board seats. Maybe those two board members exert a lot of control. But in my personal experience, boards are pretty damn passive. It’s the founders with board seats that drive everything. As we’ll see below, there are multiple individuals that are major players and I’d bet good money they have board seats. I’d be shocked if Forbes has majority control via the board.

It’s safe to say that Forbes has a minority interest in both shares and board control of Forbes Marketplace.

The Company Behind Forbes Marketplace: Marketplace Platforms Limited

Who controls Forbes Marketplace?

We’ve already established that it’s not Forbes. Forbes only controls 40%. So who is it?

Searching for Forbes Marketplace brings you to a company called Marketplace:

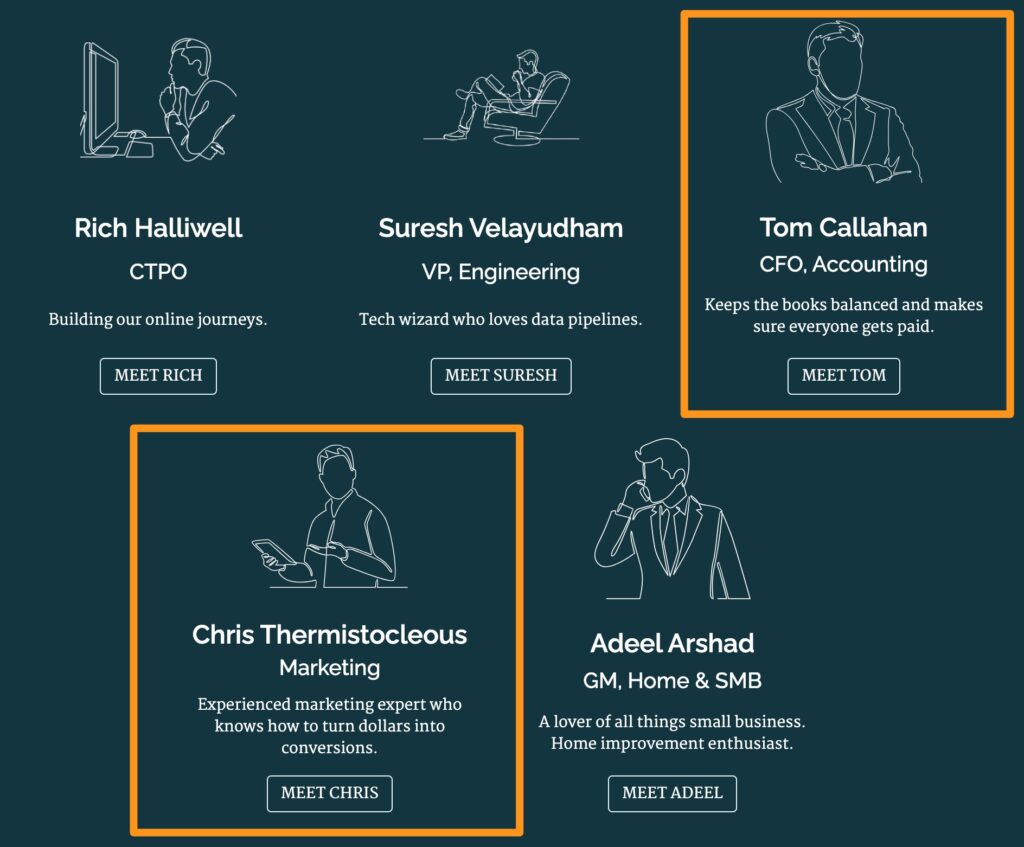

Going to the team section shows who’s actually running the show:

Hey! It’s our good friend Katie Doyle! And we have the CEO: Ash Rahimi.

Anytime you see a bullshit listing of Forbes in Google, you can blame Ash Rahimi.

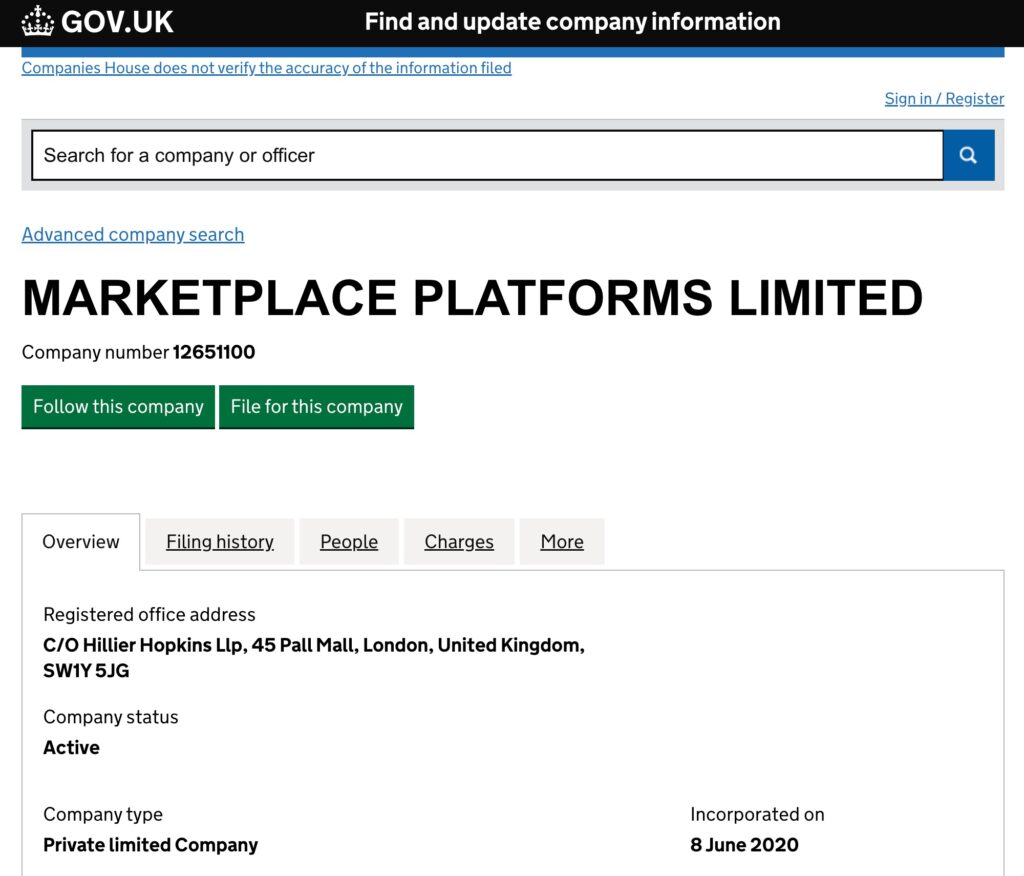

Let’s keep going. Diving into the Marketplace company eventually leads you to a London-based company that’s officially called Marketplace Platforms Limited:

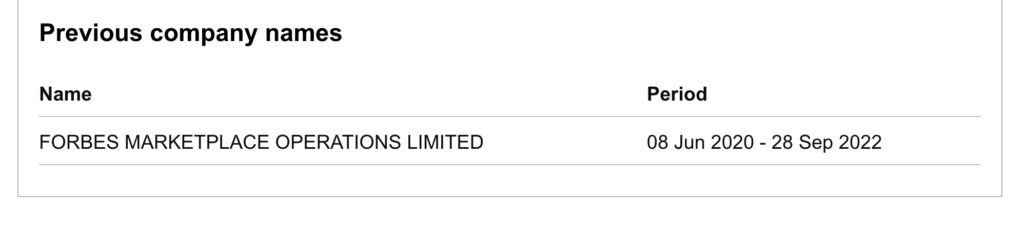

Quick tangent, Marketplace Platforms Limited used to be called Forbes Marketplace Operations Limited:

Definitely the right company.

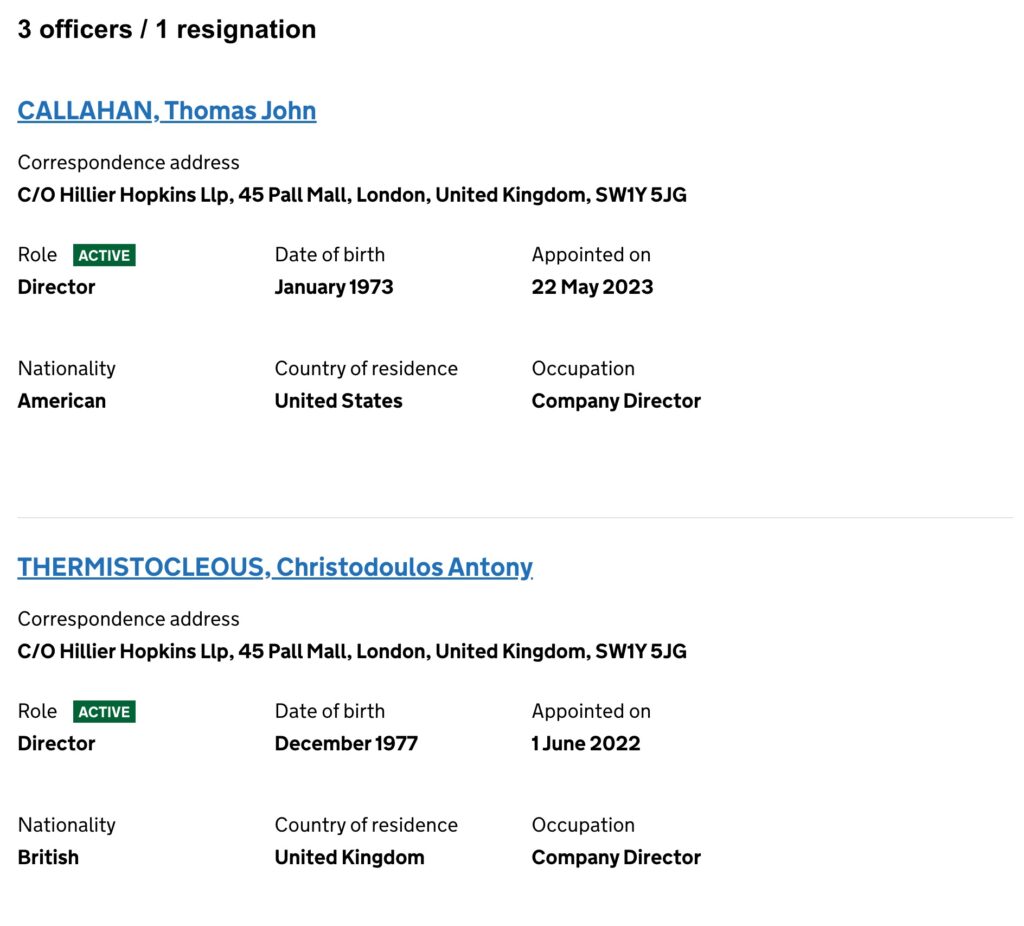

Now for why we dug this far. There are two people that are listed as the Registered Officers of Marketplace Platforms Limited:

There was a third officer (Achir Kalra) but they resigned in May 2023. Tom Callahan and Chris Thermistocleous are the two current officers. Turns out both of them also have roles at Marketplace:

But the real story comes from that resigned officer: Achir Kalra.

The Scorned Founder: Achir Kalra

On a lark, I looked around for Achir Kalra to figure out why someone would resign from Forbes Marketplace. These folks are printing cash so fast you’d need a fleet of dump trucks to move it all. Why would someone bail?

So I found his LinkedIn page. It just so happened that I found his LinkedIn at the exact perfect moment.

Recently, Achir Kalra left Forbes Marketplace/Marketplace Platforms Limited. From what I’ve seen, the transition has been contentious. Achir shared a bunch of screenshots of a text message conversation he was having with a reporter from a major news publication.

Achir posted screenshots of tons of text messages straight to his LinkedIn profile. He has since deleted them. I grabbed them all before they were taken down.

Now, I’m not going to share them all. There’s a bunch of allegations and I’m not going to wade into the fight between Achir and the Forbes Marketplace team.

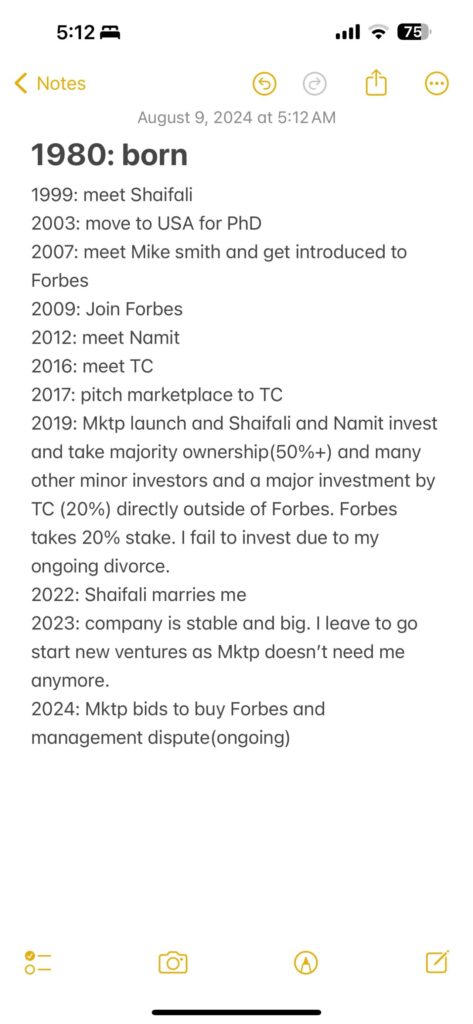

But I’m going to share one where Achir breaks down his timeline and the key players of Forbes Marketplace:

There’s a couple of key facts worth highlighting:

- Achir Kalra was involved in the founding of Forbes Marketplace, he worked at Forbes before then. Sounds like he brought a bunch of the key players together when all this started. At this point, he’s no longer involved.

- In the original version of this post, I thought TC was Tom Callahan, the current CFO of Marketplace Holdings/Forbes Marketplace. I’ve had several people tell me that TC is actually TC Yam, the Chairman of Integrated Capital. I believe this is the same Integrated Whale Media Investments that owns Forbes.

- Namit is Namit Merchant, the former COO of Media.net. Media.net was acquired by a Chinese tech company for $900 million in 2016 in an all cash deal.

- I believe Shaifali is Shaifali Sharma. There’s a company registration for Forbes Technologies India Private Limited where Shaifali and Achir are both listed as directors.

- Definitely looks like these non-Forbes folks have majority control.

These are the folks that control Forbes Marketplace.

And the biggest reveal of them all: Forbes Marketplace bids to buy Forbes in 2024.

The Forbes affiliate program has become so successful that it might gobble up Forbes itself. Does that sound like Forbes is running the show?

I’m not sure what the management dispute refers to. It could refer to the situation with Achir or it could be an entirely different controversy.

How Much Money Does Forbes Marketplace Make?

I’m going to walk you through my rough revenue estimate for Forbes Marketplace.

My estimate is definitely going to be off, I’ve had to make too many assumptions. But it’ll be in the ballpark. And the revenue is crazy enough that just getting the right number of digits is eye opening.

Forbes has stated that Forbes Marketplace earned $22 million in revenue from Jan 2021 to Sep 2021. Multiplying by a third gives us an estimate of $29 million for all of 2021. Again, traffic was on a huge upswing during this period so I’m extremely confident that $29M is a conservative estimate for 2021.

Now let’s get a traffic estimate for 2021.

- Forbes Advisor started the 2021 with about 1.2M searches per month. And ended 2021 with about 4.6M searches per month. Let’s split the two and get a very rough average for the year: 2.9M searches per month.

- Forbes Home Improvement can be ignored, it didn’t have any traffic in 2021.

- Forbes Betting can also be ignored, it didn’t start until around July 2021.

- Forbes Health did start around May 2021 and was earning 770K in monthly searches by the end of 2021. Let’s add another 500K in monthly searches for this. This overestimates the traffic in 2021 and will help make our final revenue estimate more conservative.

So we have $29M in annual revenue on an average of 3.4M searches per month in 2021.

Now for the current search traffic volume:

- Forbes Advisor = 20.6 search visits/month

- Forbes Home Improvement = 2.9 million search visits/month

- Forbes Health = 3.8 million search visits/month

- Forbes Betting = 400K searches/month

Total affiliate traffic is currently about 27.7M searches per month.

If Forbes revenue has scaled proportionally with traffic, revenue will have also grown to $236M in annual revenue.

I actually believe the real revenue is a lot higher than this:

- As search rankings improve, the value of each visitor increases. You get a larger percentage of buyers at rank #1 than you do at rank #5. When traffic grows, ALL your metrics improve (conversions, click-through rates, value per click, etc). Revenue is always higher than you expect once you go through a major traffic growth spurt.

- When you have a ton of traffic, you can squeeze your advertisers for higher commissions. A company might start out by paying you $200 for each new customer but when you have a ton of traffic, you can get $400 per customer from them. Doubling payouts from partners is very common.

- I almost missed the Forbes Betting affiliate site. And I know their team is going after other categories (like travel, automotive, and real estate). I have probably missed a few other categories that are starting to get traction and generate their own revenue.

My gut instinct estimate is that Forbes is doing $300-400M in annual revenue right now. And I’m extremely confident that they’re in the 9 digits.

No wonder they’re trying to buy all of Forbes.

Why Is Parasite SEO Even a Problem?

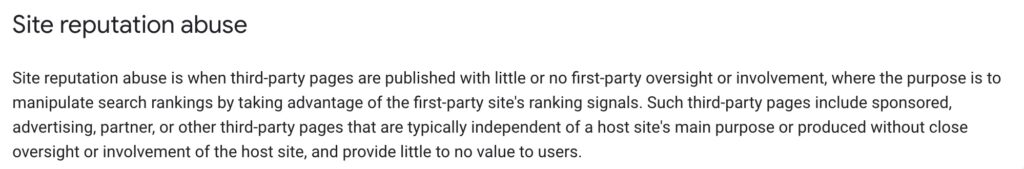

Parasite SEO is when a company abuses the domain of another company. They set up a subfolder or subdomain, then post a ton of content trying to rank on Google. Wow does that sound exactly like Forbes Marketplace.

Well, Google itself has said it’s a problem:

That’s a screenshot from Google’s own spam policies.

The key part: “third-party pages are published with little or no first-party oversight or involvement.” I would classify Forbes Marketplace as a third-party. It’s a separate business and Forbes only owns 40% of it.

As for oversight, Forbes only has 2 board seats. And really it only has one. It claims it has a second but that’s just the majority shareholder of Forbes. That individual is looking out for their own interests, not Forbes. But fine, we’ll call it 2 board seats.

I count at least 2 other major investors in Forbes Marketplace: Namit Merchant, and Shaifali Sharma. Plus the CEO usually gets a board seat (Ash Rahimi). So we have 2-3 other board seats that Forbes does not control.

Do any of these folks have backgrounds at Forbes? Nope. The one person that worked at Forbes previously was Achir Kalra and he has since left Forbes Marketplace. Not a whole lot of Forbes DNA in Forbes Marketplace.

To top it off, Forbes Marketplace has gotten so big and powerful that it’s trying to buy all of Forbes. Would that happen if Forbes was actually in control?

To me, Forbes Marketplace looks like a completely different company where Forbes is a minority shareholder.

I’d also argue that the Forbes affiliate content is “independent of a host site’s main purpose or produced without close oversight”:

- All the affiliate sites are set up in subfolders with completely different infrastructure. It’s clear that Forbes Marketplace is using its own section of forbes.com to do whatever it wants.

- Forbes Marketplace has pushed HARD into health, home improvement, and sports betting. How in the fuck is that related to the core website of business?

- When you’re making this much money, you stop asking questions. There’s no way that the Forbes editorial team is putting the brakes on anything when there’s hundreds of millions to be made every year.

- Forbes Marketplace is deliberating obfuscating who’s running the show by using the Forbes Advisor brand. It requires real digging to figure out who’s actually running the affiliate program. This was deliberate.

But maybe the Forbes Marketplace team is doing the right thing on their own? Real experts and great content?

Are any of us naive enough to believe that Forbes Marketplace has gone from nothing to 27.7M searches per month in less than 5 years while also having the expertise to truly help people across such diverse topics as credit cards, roaches, CBD gummies, and sports betting? It took Nerdwallet 15 years to do that in one category. We’re supposed to believe that Forbes can do it in at least 4 categories within 5 years? There’s no feasible way to build a team with genuine expertise that fast.

No way in hell. Forbes Marketplace is a Google heist of the highest order. It’s generic, thin content with a single goal: rank to generate affiliate revenue.

And Google has lapped their shit up.

Even Forbes Itself Can’t Be Trusted

Maybe you think I’m being too cynical. Maybe Forbes does have oversight of all the affiliate stuff.

But can we even trust Forbes itself?

Forbes was caught spoofing ad inventory. They created a new domain (www3.forbes.com), republished articles from Forbes.com, and then increased the ads in each article from 7sh to 150. And they billed their advertisers for it.

Then a bunch of agencies unknowingly bought ads from this shit alternate site for their own clients.

This went on for YEARS and they didn’t take down the spam domain until AFTER they were caught. It was theft via ad spend. Plain and simple.

This, my faithful reader, is the lauded company that Google has decided to trust above all other companies.

The Real Villain: Google

I don’t wish any ill will towards the Forbes Marketplace team.

The SEO in me respects what they’ve done. They partnered with the ideal domain, then caught a massive boom in Google as Google rolled out an extinction-level event in the SEO world while boosting massive media sites above all others (along with Reddit). And Forbes Marketplace executed perfectly. At scale.

Perfect execution and a once-in-a-lifetime lucky break.

I’m impressed. Even a little jealous.

And at the end of the day, all their employees are just doing their jobs.

But holy fuck do I have a grudge with Google.

Google has decided that Forbes is the authority in everything. Credit cards, cockroach removal, and getting too high from gummies. Forbes is now the dominant authority in damn near everything.

And that is fucking absurd.

This is not a simple mistake at this point. This was absurd back in 2022. I watch a ton of B2B search terms closely and that’s when Forbes started appearing EVERYwhere.

At the time, I thought to myself: “alright, this is getting out of hand, Google has to pair this back a bit.”

Since then, Forbes Marketplace has rolled out entire divisions to dominate the health, home, and sports categories in Google. With plans to keep going. And they’re winning. They’ll keep winning until Google gets off their ass.

I know a lot of folks in the SEO industry. Not one person thinks this is normal or okay. I even heard from a source that I deeply trust that Google employees were complaining about Forbes internally. That was two years ago.

Since then? Not a goddamn thing has changed.

Instead Google continues to unleash their HCU algorithm to nuke niche and small publishers.

The worst part about this? I suspect that all this insanity isn’t even a deliberate decision by Google. I believe the search ranking has gotten away from them. That Google isn’t in control of their own rankings or algorithms anymore. Too many subpar leaders in positions with way too much power, way too much complexity in the SERPs, and AI as a massive distraction for the entire search team.

It’s a perfect recipe for shipping shit.

And now we all have to wade through that shit every day.

UPDATES

After this post went viral, I got a lot of additional information. And there were a few minor facts that I got wrong. I’ve since corrected these in the post above:

- I got the wrong TC. I originally thought TC was Tom Callahan, the current CFO of Marketplace Holdings/Forbes Marketplace. I’ve had several people tell me that TC is actually TC Yam, the Chairman of Integrated Capital. I believe this is the same Integrated Whale Media Investments that owns Forbes.

- Also reduced the number of non-Forbes board seats that I speculated on since Tom Callahan isn’t one of the investors. TC is the investor that’s also an owner of Forbes. He’s one of the two Forbes board seats.

- Someone reached out and said I got the marriage of Shaifali and Achir slightly wrong. Apparently, there was another divorce and they’re now married. I don’t know and I’ve removed this from the post since it doesn’t really matter.

- Fixed a few typos.

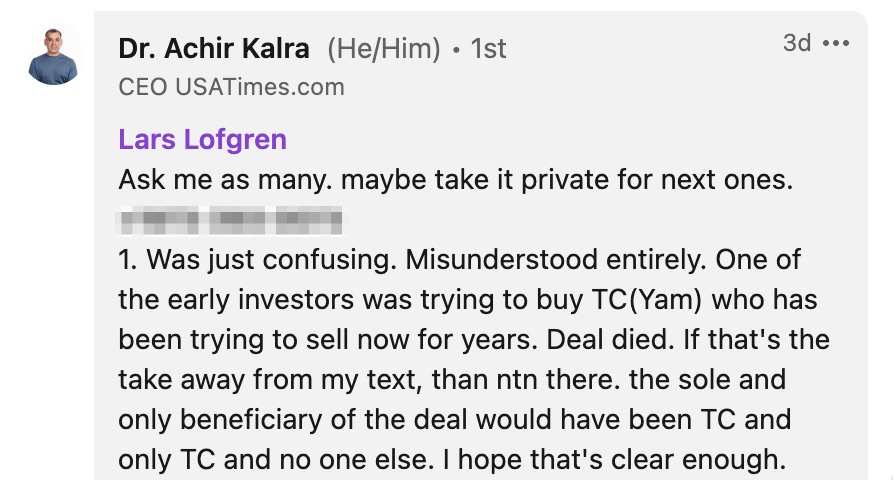

About a week after I published this post, Axios reported that Koch Inc. private equity arm is trying to buy Forbes. Achir Kalra also responded to one of my LinkedIn posts and had this to say when I asked him about the Marketplace buyout of Forbes:

My only source about the buyout is Achir Kalra so I have to defer to his description. It does sound like a deal of some kind was in play at some point but that deal is now dead.

The other thing I’ll add is that I’ve gotten a lot of notes from former employees. And a current employee responded on this thread of Hacker News. Across all the feedback I’ve gotten, I’ve gotten the impression that I got the core story right.

I’ve done a follow up to this post on how I believe Forbes Marketplace is connected to CNN and USA Today.